Cool Tool.

October 21, 2010

A blog, such as this one, is just one of a growing number of ways to research the world of real estate offerings.

A blog, such as this one, is just one of a growing number of ways to research the world of real estate offerings.

An increasing number of folks are using mobile devices as a tool to access the world of digital information.

St. Paul, Minnesota real estate blogger Teresa Boardman reports that one of the nicest mobile real estate search apps is from Realtor.org.

I would agree.

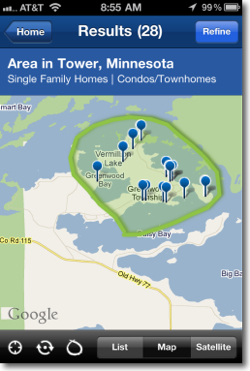

Here is a screen shot from that app with a nifty feature that allows you to circle a specific geographical area and then display the properties currently offered for sale within the selected space.

That’s pretty cool.

There are numerous other ways to search plus you can save listings of interest or forward information via email.

View all the app details here. Download the (free) app. Search your area of interest. Make a list of properties that meet your needs. Call your realtor and arrange a tour. Make an offer. Close the deal. Move in and enjoy.

Bill Tibbetts

Associate Broker

Bill Tibbetts

Associate Broker