Taking The Fifth.

September 27, 2011

One of the more popular questions related to the value of an undeveloped lake shore parcel is “What’s the current price price per foot of this lakeshore?”. I believe the best answer to that is a politician-style non-answer.

Why? Because there is no absolute number that is an accurate response. There is no place to look up the current price for a foot of Lake Vermilion lakeshore frontage. Any firm number offered as an answer to that question is a fictitious statistic.

That’s my opinion.

The value of any individual undeveloped lakeshore parcel is influenced by the numerous physical facts of that parcel. It’s much more involved than a “current price per foot”.

Typical factors that may influence value include: Location (on the lake and on the road), topography, size, shape, tree cover, privacy, seclusion, lakeshore quality, direction, ability to support improvements, access to utilities, and others.

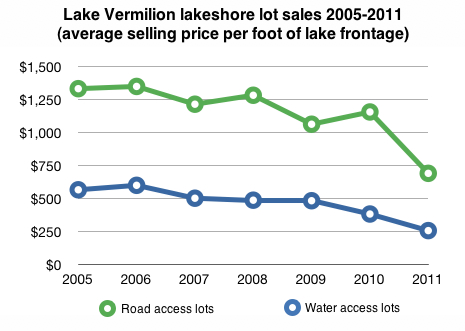

It is verifiable that overall lakeshore property values are trending downward. (See the following graph.) But just because the current average value per foot is X amount of dollars does not mean that every parcel has that approximate value.

For the 7 year time period illustrated in the graph the average variance from highest price per foot to lowest price per foot is $513 for water access lots and $1,265 for road access lots. That makes it very hard to answer the “price per foot” question with a finite number.

The beauty and attraction of lakeshore property is the individual and subjective qualities of any given parcel.

Overall prices are down but individual value remains unique.

Bill Tibbetts

Associate Broker

Bill Tibbetts

Associate Broker